How to Navigate the Highs and Lows of Entrepreneurship

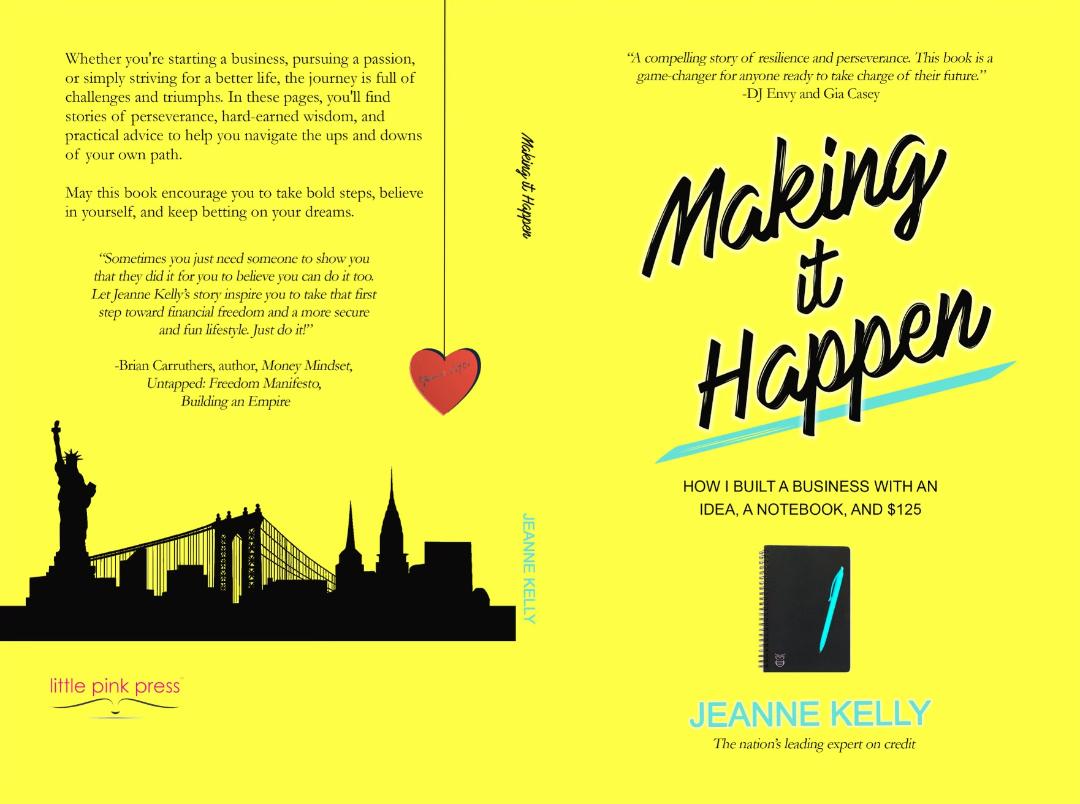

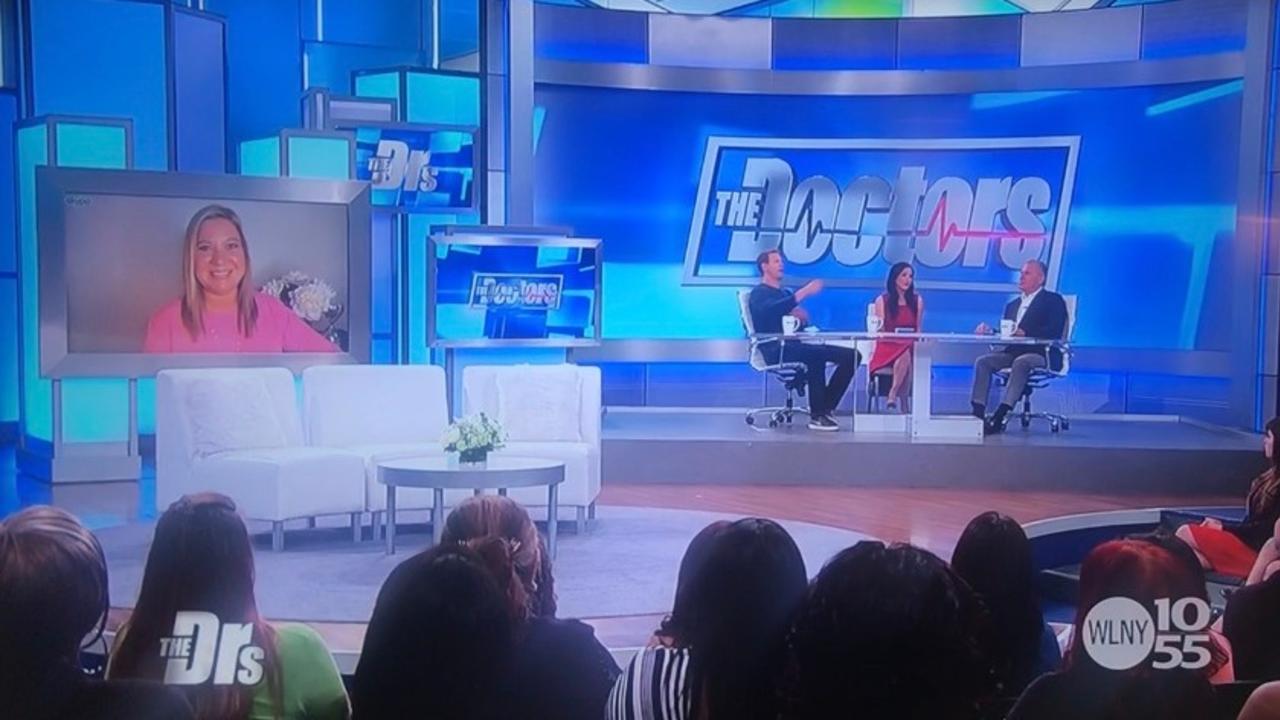

Imagine this. After two years of growing your business things are finally taking off. You have comfortableincome to cover expenses, employ staff, open up offices, and even take on a mortgage. Then,the economy crashes. About 70% of your business dries…